A Look at May’s Real Estate Markets in Fairfield & New Haven Counties. Staying informed about local market trends is essential whether you’re selling or buying. I am a reliable source you can depend on. With experience as a homeowner, investor, landlord, builder, and mortgage loan officer, I provide insight and guidance throughout the home selling or buying process. Let’s work together to make your real estate journey a smooth and successful. I’m ready when you are!

Keep up with your Neighborhoods Market Trends. Sign up at neighborhood news to get the most current real estate market inside scoop. Get updates for the community you love.

Here’s a look at what’s happening with the economy and our local housing market.

Our Economy

Inflation was cooler than expected in May, and overall CPI (consumer price inflation) rose to 2.4%. Gas prices fell and tariffs had little impact. Prices for new and used cars fell in May, along with prices for airline fares and clothes. Meanwhile, car repair costs are soaring, indicating a labor shortage and the need to attract more young adults to the trade fields.

Mortgage demand rose to the highest level in over a month. Purchase apps were up 10% for the first week of June and were 20% higher than a year ago.

Analysts say that with the labor market holding, the Fed has some wiggle room to keep rates steady for now. The Fed will remain at pause until inflation is fully contained at or below 2%. Wall Street bettors are pointing to September as the first of several potential rate cuts.

The next Federal Reserve meeting is June 18-19.

Jobless claims rose slightly higher than forecast for the 2nd week in June, yet recurring applications did not imply any significant increase in job losses. In short, there’s a small rise in new unemployment claims, but it’s not enough to signal a serious downturn in the job market.

Inventory & Demand

There was an increase in inventory in both Fairfield and New Haven Counties for single family homes and condos for sale. However, inventory still cannot keep up with the demand of buyers in both Counties. Considering selling? Homeowners aim to benefit from current home values.

According to data from the NAR, First-time buyers decreased to 24% of the market share (32% last year). This year marks the lowest share since NAR began collecting data in 1981.

The median first-time buyer age increased to 38 years old this year from 35 last year, while the typical repeat buyer age also increased to 61 years from 58 last year.

Buyers are out there! With most home buyers, the purchase of real estate is one of the largest financial transactions they will make. Buyers purchase a home not only for the desire to own a home of their own, but also because of changes in jobs, family situations, and the need for a smaller or larger living area.

The overall state of residential real estate markets is varied, with reports indicating persistent inventory constraints. Property values are rising, attracting motivated buyers who might find your home perfect. With strong interest in the market, this is an ideal opportunity for a successful sale.

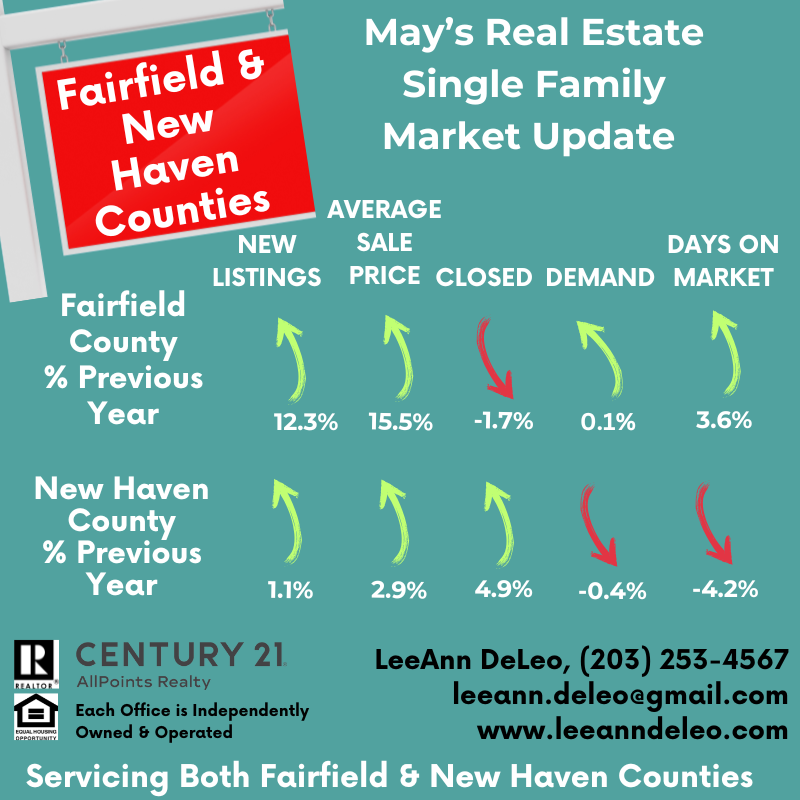

Average Sales Price – Fairfield & New Haven Counties

How did May 2025 compare to last year at this time? Single Family home prices in Fairfield County are up 15.5%. The average sales price is $1,262,668. The number of homes sold was down -1.7% and days on the market are 29 days, which is up 3.6%. The Condo/Townhouse average sales price also rose11.8% with an average sale price of $506,230. Condo sales were up 5.8% and 29 days on the market until closed.

New Haven Counties Single Family home prices were also up 7.7% with an average selling price of $480,241. Closed home sales rose 4.9% and days on the market fell shyly at 23 days, down -4.2% from this time last year. As for the Condo/Townhouse sales, the average sale price is $326,932 which is up 5.5%. Closed sales were down -10.2% and the average days on the market increased by 20% to 30 days to closing.

Fairfield and New Haven Counties are about 30 miles apart, a short distance on I-95 and a quick commute to New York and Hartford. Explore the diverse regions of lower and upper Fairfield and New Haven Counties. There are a variety of price points available to accommodate any home budget and lifestyle.

Lower Fairfield County offers a unique blend of vibrant urban living, coastal allure, and convenient access to New York City and nearby highways. The advantages of this desirable lifestyle generally start at a base price of approximately $700,000, with many properties often exceeding one million dollars.

New Haven County along with some areas in Upper Fairfield County presents a base price point of approximately $430,000 with increases observed along the shoreline. It also provides convenient access to local highways, railways, urban amenities, and coastal attractions.

Pricing for properties in the Southwestern region of New Haven County are approximately $380,000 offering a more rural atmosphere and suitable options for those who prefer a country town setting.

Don’t LOVE Where You Live?

If you don’t love where you live? Let’s Talk! Consult a Professional REALTOR® like me. I specialize in helping sellers, buyers, seniors, relocation, landlords and up or down sizers.

Selling or Buying – Contact LeeAnn Today (203) 253-4567

Request a complimentary NO obligation consultation. Consider recommending a friend or family member. I’ve assisted 100’s of sellers and buyers achieve their real estate goals. I can help you too! I am committed to treating you as part of the family.

Raise your standards! Your real estate goal is a journey filled with significant financial decisions and personal choices. It’s essential to partner with an experienced REALTOR® like me.

Compliments of LeeAnn DeLeo, A Trusted Name in Real Estate

Broker, Blogger, Stagent® & REALTOR®

(203) 253-4567

leeann.deleo@gmail.com

www.leeanndeleo.com

Follow, Like & Share with me on SM

Facebook Pages: LeeAnnDeLeoRealEstate and my personal page LeeAnnDeLeo

Blog Sites: Local Market News and Blog Spot

YouTube Channel: LeeAnnDeLeo

Source: SmartMLS, Federal Reserve, US Economy, MBA – The information provided herein is for informational purposes only.

All real estate, economic data, market trends and projections are subject to change.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link