A Glance at July’s Market: Lets Rewind Real Estate to 2023

Selling or buying, staying informed about local market trends is essential! Here is a glance at July’s market and lets rewind real estate to 2023, to help keep you informed. I provide insight and guidance throughout the home selling or buying process. I am a reliable source you can depend on with experience as a homeowner, investor, landlord, builder, and mortgage loan officer. I guarantee you a seamless transaction. Let’s work together to make your real estate journey smooth and successful. I’m here to help and am ready when you are!

Keep up with your Neighborhoods Market Trends. Sign up at neighborhood news to get the most current real estate market inside scoop. Get updates for the community you love.

Let’s rewind the real estate market clock to 2023, looking back 2 ½ years ago to July 2025. Here’s a look at what’s happening with the economy and our local housing market.

Our Economy

Trump administration considers removing capital gains taxes on home sales to revive housing market as an incentivize to sellers to list their homes. Capital gains tax changes may rock housing market. Homeowners could see a big change in the taxes they pay when they sell their home according to the TheStreet.Com read the full story here bit.ly/452bbQC

The annual inflation rate for the United States was 2.7% for the 12 months ending June, compared to the previous rate increase of 2.4%, according to U.S. Labor Department data published on July 15, 2025

July’s weaker jobs report raises concerns about slowing hiring and ongoing economic uncertainty from trade issues and inflation. The unemployment rate edged up to 4.2%, from 4.1%. While this may increase chances of a Fed rate cut in September, policymakers are waiting for more data before making any decisions.

For most of 2024, mortgage rates lingered in the 6% and 7% range. The Fed pivoted back to rate cuts for most of 2024 in September, October and December of that year. Rates rose from September 2024 to early 2025. For the first five Fed meetings of 2025, the Fed opted to hold its benchmark rate, awaiting changes in unemployment and inflation data before making its next move.

The next Federal Reserve meeting is September 16-17. Meeting associated with a Summary of Economic Projections.

Mortgage Rate History

In 1981 the average mortgage rate for a 30-year fixed mortgage peaked, rising just above 16%.

In 1998 we saw a significant shift in the 30-year mortgage rate, it plunged to an average of 6.9%

In 2021 the average 30-year fixed rate bottomed out at just under 3%

For most of 2024, mortgage rates lingered in the 6% and 7% range.

As of now, forecasters predict rates to move between 6% and 7% for the remainder of the year.

In summary, with stable forecasts ahead, buyers can plan confidently and take advantage of a more predictable market.

Inventory & Buyer Demand

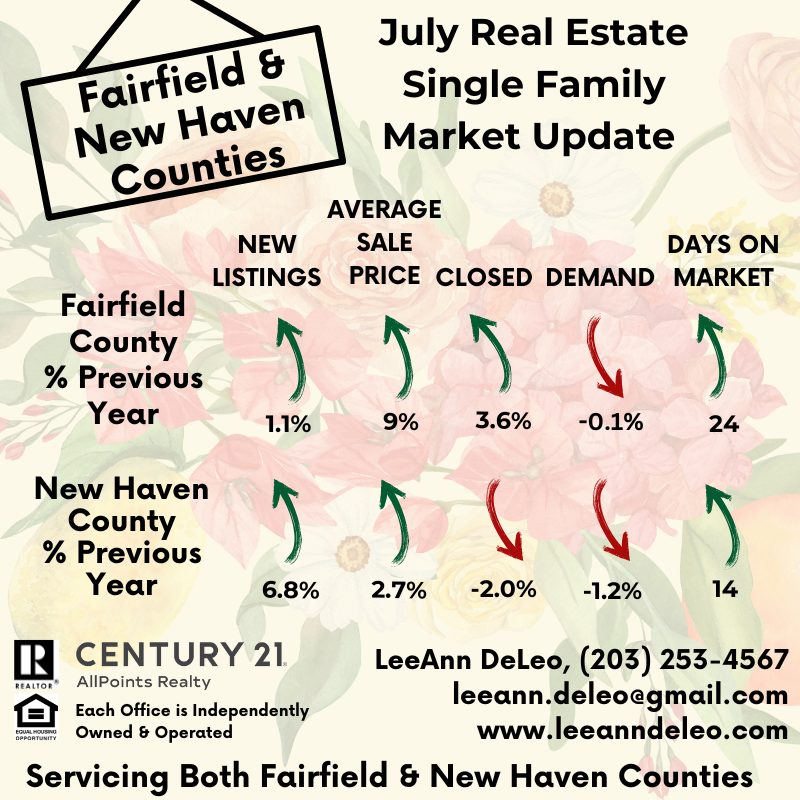

Here’s how the numbers have shifted in 2 ½ years for inventory from 2023 – July 2025. Inventory in both Fairfield County and New Haven Counties decreased by slightly over 44%. That is a significant number of homes NOT for sale. This is a very good reason to consider selling your home now.

The buyers demand for Fairfield County over the past 2 ½ years from 2023 – July 2025 slightly increased from 2.1% to 2.9% over ask on closed homes. New Haven County has sustained an over ask on closed homes at around 2%.

Buyer demand is the amount a buyer is willing to pay over ask when purchasing a home. Buyers are still buying home despite what rates are.

New listings rose slightly in Fairfield County while New Haven County jumped up by over 6.5% in inventory compared to this time last year.

Closed home sales were up in both Fairfield and New Haven Counties, which means many see the summer as the right time to make their move.

Average Sales Price

Here’s what’s changed. In the past 2½ years, the market’s home values have made some big moves. Fairfield County Single Family homes average sales price rose by 20% and Condo’s increased by over 9% in value from 2023. The New Haven County housing price market for Single Family’s was up over 15% and Condo’s climbed over 17% in value from 2023.

Our market is speaking; the average sale price of homes continues to rise. Over the past 2 ½ years we have seen a significant jump in home values in both Fairfield and New Haven Counties. This market continues to be an ideal opportunity to list your home for sale.

If you think purchasing in Fairfield County is out of your price point you may want to explore other options. New Haven County has an average sale price of just over $500k with purchasing options beginning in the low $400’s.

For those seeking an exceptional life. Both counties sit just 30 miles apart, connected by I-95 and offering a quick commute to both New York City and Hartford. From the coastal towns to countryside communities, these counties offer a wide range of lifestyles and price points.

Don’t LOVE Where You Live?

If you don’t love where you live? Let’s Talk! When only the best will do, consult a Professional REALTOR® like me. I specialize in helping sellers, buyers, seniors, relocation, landlords and up or down sizers.

Selling or Buying – Contact LeeAnn Today (203) 253-4567

Request a complimentary NO obligation consultation. Consider recommending a friend or family member. I’ve assisted 100’s of sellers and buyers achieve their real estate goals. I can help you too! I am committed to treating you as part of the family.

Raise your standards! Your real estate goal is a journey filled with significant financial decisions and personal choices. It’s essential to partner with an experienced REALTOR® like me.

Compliments of LeeAnn DeLeo, A Trusted Name in Real Estate

Broker, Blogger, Stagent® & REALTOR®

Century21 AllPoints Realty

(203) 253-4567

leeann.deleo@gmail.com

www.leeanndeleo.com

Follow, Like & Share with me on SM

Facebook Pages: LeeAnnDeLeoRealEstate and my personal page LeeAnnDeLeo

Blog Sites: Local Market News and Blog Spot

YouTube Channel: LeeAnnDeLeo

Source: SmartMLS, Federal Reserve, US Economy, MSN, BankRate, MBA – The information provided herein is for informational purposes only. All real estate, economic data, market trends and projections are subject to change.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link