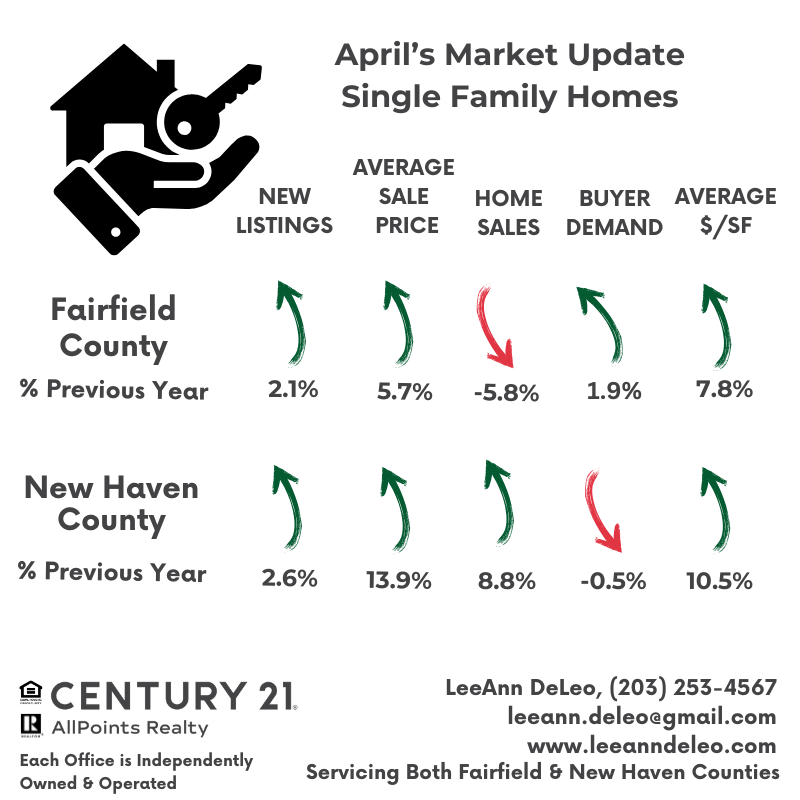

Residential real estate markets are mixed. A glance at April’s real estate market for Fairfield and New Haven Counties. Being well informed about the local market and economy is key whether selling or buying a home. Partnering with a knowledgeable REALTOR® like me is crucial. I bring skill as a homeowner, investor, landlord, builder, and mortgage loan officer. This partnership will guarantee a seamless and rewarding experience.

Keep up with your Neighborhoods Market Trends. Sign up at neighborhood news to get the most current real estate market inside scoop. Get updates for the community you love.

Here’s a look at what’s happening with the economy and the housing market. Having a strong grasp of the economy and local market will make all the difference in reaching your goals. It’s essential to stay informed through a reliable source like me.

Our Economy

Buyers returned to the spring market despite economic jitters. Purchase mortgage apps rose 11% for the week and 13% from a year ago according to the MBA. First-time homebuyers represented 58% of agency purchase lending in the 1st quarter of 2025. This data comes from the ICE Mortgage Monitor.

The Federal Reserve held interest rates steady at its May meeting. “We don’t have to be in a hurry. The economy is resilient and doing fairly well,” Fed Chair Jerome Powell. The next Federal Reserve meeting is June 17-18 and will include a “Summary of Economic Projections.”

Jobless claim applications fell by 13,000 to 228,000 for the week ending May 13th according to the Labor Department. In short, fewer people filed for unemployment that week. This suggests the job market is getting stronger and more stable.

The CPI (Consumer Price Index) in April rose to 2.3% on an annual basis, indicating an overall easing or slowdown in inflation. However, housing “shelter” costs continue to rise. Shelter costs increased by 4.0% year-over-year, marking the smallest annual rise since November 2021.

What’s This Mean for You?

Renting, your rent might still rise, but future increases could slow down.

A Homeowner, fixed mortgage rates will stay the same, but costs like insurance and maintenance could still rise.

Simply House hunting, price growth may slow. We are not seeing this in Fairfield & New Haven Counties.

Inventory & Demand

Both Fairfield and New Haven Counties had a significant jump in inventory for both single family homes and condos for sale. The rise in listings indicates that more homeowners are entering the market. They are driven by sustained buyer demand. Homeowners aim to benefit from current home values. However, inventory still cannot keep up with the demand.

According to data from the National Association of Realtors (NAR), first-time buyers now make up just 24% of the market. The median age of first-time buyers rose to 38, while repeat buyers are even older, typically 61 years old, up from 58 the year before. This indicates just how challenging affordability has become, especially for younger buyers that are trying to break into the market for the first time.

More buyers are contemplating an ARM loan. It often comes with a lower initial interest rate than that of a comparable fixed-rate mortgage, giving you lower monthly payments, at least for the loan’s fixed-rate period.

Now is a great time to sell your home. Property values continue to rise, making it an ideal moment to list. Many motivated buyers are actively looking for a place to make their own—and your home could be just what they’ve been searching for. With strong interest and serious buyers in the market, this could be the perfect opportunity to make a successful sale.

Overall residential real estate markets are mixed, and reports point to ongoing inventory constraints. Another great reason to consider selling.

Average Sales Price – Residential Real Estate Markets are Mixed

Fairfield and New Haven Counties are about 30 miles apart, a short distance on I-95 and a quick commute to New York and Hartford.

Spring home sales are in the air. The average sales price for single family homes in Fairfield County was just over $1,1M which is an 18% increase from this time last year. Condo’s average rose 20% from this time last year to $490K.

New Haven Counties average sale price for single family homes jumped over 9% from this time last year to $501K. Their condo market also increased by over 10% from this time last year to just under $323K.

Fairfield County combines vibrant city life, coastal charm, easy access to NYC and local highways. The benefits of this convenient lifestyle typically begin at a base price of approximately $650,000, with prices often exceedingly well over one million dollars.

New Haven County offers a more modest base price point of approximately $390,000 with upswings along the shorelines. Also keeping you connected to local highways, railways, city life, and that irresistible coastal charm.

Don’t LOVE Where You Live?

If you don’t love where you live? Let’s Talk! Consult a Professional REALTOR® like me. I specialize in helping sellers, buyers, seniors, relocation, landlords and up or down sizers.

Selling or Buying – Contact LeeAnn Today (203) 253-4567

Request a complimentary NO obligation consultation. Consider recommending a friend or family member. I’ve assisted 100’s of sellers and buyers achieve their real estate goals. I can help you too! I am committed to treating you as part of the family.

Raise your standards!

Your real estate goal is a journey filled with significant financial decisions and personal choices. It’s essential to partner with an experienced REALTOR® like me.

Compliments of LeeAnn DeLeo, A Trusted Name in Real Estate

Broker, Blogger, Stagent® & REALTOR®

(203) 253-4567

leeann.deleo@gmail.com

www.leeanndeleo.com

Follow, Like & Share with me on SM

Facebook @LeeAnnDeLeoRealEstate and my personal page @LeeAnnDeLeo

Blog Sites Local Market News and Blog Spot

You Tube @LeeAnnDeLeo

Source: SmartMLS, Federal Reserve, US Economy, MBA – The information provided herein is for informational purposes only.

All real estate, economic data, market trends and projections are subject to change.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link